Buy Bitcoin With Cash Deposit

Wallet Service

Coinbase offers our USD Wallet and Hosted Cryptocurrency Wallet Service free of charge. This means we will store your USD and cryptocurrency at no cost to you. 'Cryptocurrency' means any cryptocurrency currently supported by Coinbase. We do not charge for transferring cryptocurrency from one Coinbase wallet to another. Coinbase incurs and pays network transaction fees, such as miner's fees, for transactions on cryptocurrency networks (i.e., transfers of cryptocurrency off the Coinbase platform). For these transactions Coinbase will charge you a fee based on our estimate of the network transaction fees that we anticipate paying for each transaction. In certain circumstances, the fee that Coinbase pays may differ from that estimate. All fees we charge you will be disclosed at the time of your transaction.

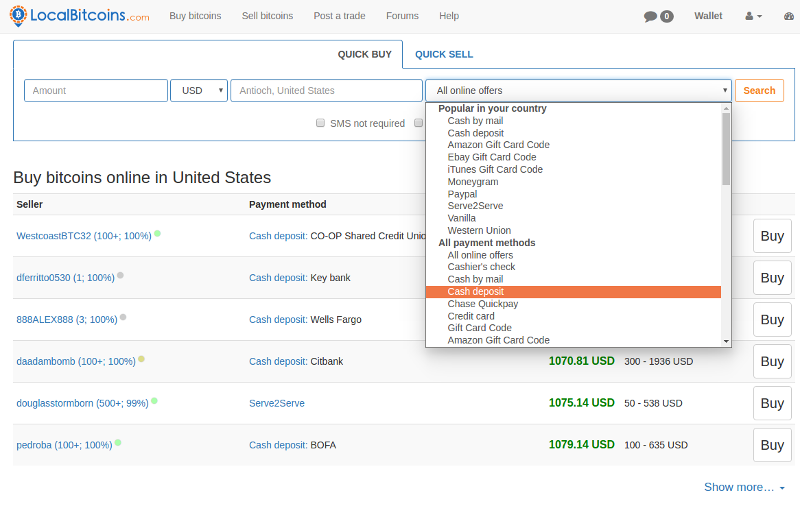

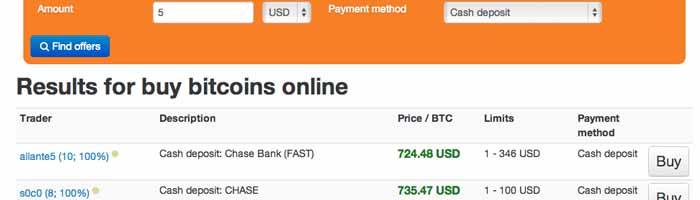

- Use filter to narrow down the search and view only the offers that are in the scope of your interest. If you wish to buy bitcoins for any fiat currency using HSBC Cash Deposit worldwide, type desired parameters in the filter and press «Search». Search results will give you best possible options.

- Alternatively, if the current price of Bitcoin is $10,000 but I only want to pay $9,000 maximum, I can set a limit buy order for $9,000 and my order will only go through if someone offers to sell a Bitcoin for $9,000 or less.

Buy Bitcoin Cash You do not have enough available funds in your account. You will need to complete an instant deposit via POLi or PayID, or alternatively deposit via BPAY or Cash Deposit.

Cryptocurrency Transactions

General

In addition to sending or receiving cryptocurrency through Coinbase, customers can (1) purchase or sell a single cryptocurrency (a “cryptocurrency purchase” or “cryptocurrency sale”), or (2) convert one type of cryptocurrency into another type of cryptocurrency (a “cryptocurrency conversion”). After signing in to Coinbase.com, select the blue Trade button to view this screen.

When you request a cryptocurrency transaction, Coinbase will attempt to fill that order through one or more orders on Coinbase’s trading platform, Coinbase Pro. Coinbase establishes the exchange rate for cryptocurrency transactions (“consumer exchange rate”) by adding a margin, or spread (the “spread”), to the market exchange rate on Coinbase Pro (“Pro exchange rate”). Coinbase may also charge a separate fee (in addition to the spread) that is either a flat fee or a percentage of the transaction (the “Coinbase Fee”), as further described below in the section entitled Buy/Sell Transactions. Coinbase Fees may vary based on your location, payment method, and other circumstances. In some cases, we may charge an additional fee on transfers to and from your bank account. We will always notify you of all Coinbase Fees (not including the margin) and any other service fees that apply to each transaction immediately before you confirm each transaction and in the receipt we issue to you immediately after each transaction has processed.

Coinbase reserves the right to reject a transaction if Coinbase is unable to fill a corresponding order on Coinbase Pro due to changes in the market price of a cryptocurrency, an order exceeding the maximum order size on Coinbase Pro, or an order timing out due to slow server response time. In rare circumstances, the Pro exchange rate may not be available due to outages or scheduled maintenance. In order to provide you with uninterrupted services at such time, we may derive market pricing data from unaffiliated currency exchanges. Exchange rates quoted in these circumstances are subject to a quoted spread exceeding 50 basis points.

Buy/Sell Transactions

Coinbase charges a spread of about one-half of one percent (0.50%) for cryptocurrency purchases and cryptocurrency sales. However, the actual spread may be higher or lower due to market fluctuations in the price of cryptocurrency on Coinbase Pro between the time we quote a price and the time when the order executes.

We also charge a Coinbase Fee (in addition to the spread), which is the greater of (a) a flat fee or (b) a variable percentage fee determined by region, product feature, and payment type. The flat fees are set forth below:

- If the total transaction amount is less than or equal to $10, the fee is $0.99 €0,99 £0,99 C$.99

- If the total transaction amount is more than $10 but less than or equal to $25, the fee is $1.49 €1,49 £1,49 C$1.49

- If the total transaction amount is more than $25 but less than or equal to $50, the fee is $1.99 €1,99 £1,99 C$1.99

- If the total transaction amount is more than $50 but less than or equal to $200, the fee is $2.99 €2,99 £2,99 C$2.99

For example, if you are in the United States and wish to purchase $100 of bitcoin and pay with a US bank account or your USD Wallet, the flat fee would be calculated as $2.99. As noted below in the variable fee section, the variable percentage fee would be 1.49% of the total transaction, or $1.49. Since the flat fee is greater than 1.49% of the total transaction, your fee would $2.99. If you wanted to purchase bitcoin with a debit card, we would charge a fee of 3.99% since the variable percentage fee is higher than the flat fee.

Variable percentage fee structure by location and payment method are shown in the last section below. These fees do not apply to cryptocurrency conversions. As a reminder, the Coinbase Fee will always be the greater of the minimum flat fees described above or the variable fees described below.

Credit Transactions

How To Buy And Sell Bitcoin

If you borrow USD from Coinbase or an affiliate of Coinbase, and we sell your BTC collateral as we are authorized to do under an applicable loan agreement, we will charge you a flat fee of 2% of the total transaction.

Cryptocurrency Conversions

With a cryptocurrency conversion, you can accomplish in a single transaction what would otherwise require two separate transactions. For example, you could directly convert bitcoin to Ethereum (a cryptocurrency conversion), or you could sell bitcoin and then purchase Ethereum (a cryptocurrency sale followed by a cryptocurrency purchase).

Coinbase charges a spread margin of up to two percent (2.00%) for cryptocurrency conversions. The actual spread margin charged varies due to market fluctuations in the price of cryptocurrency on Coinbase Pro between the time we quote a price and the time when the order executes. We do not charge a separate Coinbase Fee for cryptocurrency conversions.

For US customers only: cryptocurrency conversions ending or starting with USDC are treated as cryptocurrency purchases and cryptocurrency sales respectively, and are charged a spread and Coinbase Fee as stated above for “Buy/Sell Transactions.'

Variable Fees by Location and Payment Method

Australia

| Credit / Debit Card Buys |

| 3.99% |

Canada

| Debit Card Buys |

| 3.99% |

Europe

| Standard Buy/Sell | Instant Buys (debit card only) | Bank Transfers (SEPA) - in/out* | Instant Card Withdrawal |

| 1.49% | 3.99% | Free/€0.15 | up to 2% of any transaction and a minimum fee of €0.55 |

If you send a SWIFT payment, it is subject to a €5 fee that we are not able to waive. If your payment is for less than €5, your funds will not be returned.

Singapore

| Credit / Debit Card Buys |

| 3.99% |

UK

| Standard Buy/Sell | Instant Buys (debit card only) | Bank Transfers (SEPA) - in/out* | Faster Payments | Instant Card Withdrawal |

| 1.49% | 3.99% | Free/€0.15 | Free | up to 2% of any transaction and a minimum fee of £0.55 |

USA

Base rate of 4% for all transactions**

| Payment Method for Purchase/Payout Method for Sale | Effective Rate of Conversion Fee (after waiver) |

| US Bank Account | 1.49% |

| Coinbase USD Wallet | 1.49% |

| Debit Card Buy | 3.99%*** |

| Instant Card Withdrawal | up to 1.5% of any transaction and a minimum fee of $0.55 |

| USD Deposit Method | Fee |

| ACH Transfer | Free |

| Wire Transfer | $10 ($25 outgoing) |

All debit card payments are processed through Coinbase, Inc.

Buy Bitcoin With Cash Deposit

Please note:

* In some cases your bank may charge additional fees for transfers between your bank account and your Coinbase account.

** The base rate for all purchase and sale transactions in the US is 4%. Coinbase waives a portion of the cryptocurrency transaction fee depending on the payment method you use. The effective rate of the cryptocurrency transaction fee disclosed here is calculated as the base rate, net of fee waivers. The base rate does not apply to US Dollar deposits and withdrawals.

*** Your bank may charge additional fees for Coinbase credit card purchases. To avoid these fees, switch to debit card or bank account.

Staking Services

Commission

When you hold cryptocurrency on Coinbase, you may be given the option to “stake” these assets in a third party proof-of-stake network via staking services provided by Coinbase. Please see our staking information page for more information regarding staking and Appendix 6 of the Coinbase User Agreement for applicable terms and conditions. If you stake your assets with us, your reward will be determined by the protocols of the applicable network. Coinbase will distribute this reward to you after receipt by Coinbase, minus a 25% commission.

One of the major features of Bitcoin is that it’s peer-to-peer (P2P), meaning, you can send and receive Bitcoin with your peers around the world without having to go through a middleman like a financial institution.

However, over the years as Bitcoin has become more popular, we’ve seen less P2P-style transactions as more centralized services such as exchanges and payment providers come on to the scene. This is because these services make buying and selling Bitcoin easy, but with convenience comes a cost.

Not only do we mean a financial cost because you pay premium fees for these services, but you also lose privacy and in many cases anonymity. Mainly due to Know-Your-Customer (KYC) rules with exchanges and them requiring personal and sensitive information about you, such as your name, address, phone number and other identification. This has put a real burden on the space for those that want to trade without this sort of interference.

Fortunately, over the years there have been different services that offer local trading but many of them haven’t taken off so aren’t well known and have no liquidity or have succumbed to government regulations making them not local nor P2P; they aren’t P2P if they let the government intervene in transactions and stopping trades due to aggressive over-reaching rules and regulations.

Enter in Local Bitcoin

Local Bitcoin (Local.Bitcoin.com) aims to break the mold and bring back P2P transactions to Bitcoin. Using Bitcoin Cash as it’s base currency, users can now buy and sell Bitcoin Cash with each other with no middleman. In addition, because of the way Local Bitcoin is setup using Blind Escrow, Local Bitcoin never touches any funds whatsoever – which means that there is no KYC at all on the platform. Users can trade with each other with confidence, privately and anonymously.

Getting Started on Local Bitcoin

Getting started on Local Bitcoin is extremely easy. The first step if you aren't registered is to sign up for the platform. All that is needed is an email address. Once registered make sure to verify your email address and setup two factor authentication for security reasons. You can do this in the My Account section.

If you want to buy Bitcoin Cash the next step is to visit the Offers page which will have filters at the top. Make sure to change your filter to “I want to Buy BCH.” You can then filter further on Payment Methods to a type that you prefer, for example you can change it to “Cash deposit” where you deposit cash to the sellers bank account directly so they can sell you Bitcoin Cash. You can also filter by location which will help narrow down the search to sellers in your area.

Buying Bitcoin Cash

Buying isn’t as hard as it seems, but as a first-time buyer this task may seem daunting. Don’t fret, it’s not so bad in retrospect. The first thing you will want to do is click on the offer you're interested in. You will be presented with the offer page to open the trade with the amount you want to buy. The page will also provide details about the seller. Make sure to review it including their feedback and reputation. You can click on the seller’s name to view their profile to view the details there too. The page also includes the Terms of the trade so you understand how the seller expects the trade to go, for example it may say something like “deposit cash to Bank, account details will be provided over chat.”

Once the trade is opened, it will create the Trade page with the seller. It includes a fully encrypted chat session so you can talk to the seller and they can talk to you. A best practice will be to send them a quick message just saying you are ready to trade with them and provide some details such as “I’m ready to trade, please provide your bank deposit information.” If you aren't sure, just ask the seller what is the first step to start the trade.

On the seller’s end they will then have to put their BCH in escrow where it’s held in a Blind Escrow. Once that is done and while communicating with the seller via the chat, you will want to send the payment to them. When you are done making the payment, make sure to click the “Mark As Paid” button on the offer. After they have received the payment and have confirmed it on their end, they will release the funds sitting in escrow to you.

Once the escrow is released, the funds will be sent to you in your Wallet on the Local Bitcoin page and you are done – the transaction is complete! Make sure to give the seller a thumbs up or down depending on how smoothly the transaction went. The seller can also provide the same feedback to you as the buyer. Doing this helps to build reputation on the site for all parties.

Buy Bitcoin Instantly With Bank Account

Have more questions? Make sure to read all theLocal Bitcoin FAQswhich covers many areas from security, to usage, escrow and disputes.